It’s that time of year again, time to fill in your tax return

And now you realise that all those receipts and documents, that you’ve been promising yourself you’d sort out all year, are still in a carrier bag, still in your “in” tray, or screwed up at the bottom of your bag.

You’re going to need to put them in to some kind of organisation so you can pull out the right numbers.

WELL I HAVE A SYSTEM FOR THAT, AND OF COURSE IT’S A SPREADSHEET! ⭐

It’s the same one I use when I help my clients but of course I can’t prepare everyone’s tax return for them. So I’m making it available to you, because I know it will save you loads of time compared to setting everything up from scratch.

You can be sure that the formulas are correct and that once you’ve given each expense a category your numbers are ready to use.

If your accounting needs are quite simple – and you want to make the job of organising your invoices and receipts in to a profit and loss statement, and having the right numbers for the right boxes on the self-employment tax return, super duper easy – then you need to have a copy!

This is a simple, one year, business income and expenditure tracker for freelancers and sole traders, under the VAT threshold, and using the financial year as an accounting year. You can track your numbers, produce a profit and loss statement and have the figures ready for your annual self-assessment tax return.

If your annual business turnover is less than the VAT threshold for the tax year then when completing your self-assessment tax return you can use the supplementary form SA103S(short) to record self-employment income on your SA100 tax return.

THE SPREADSHEET WILL WORK ON THE DESKTOP VERSION OF MICROSOFT EXCEL ON BOTH A WINDOWS PC AND A MAC

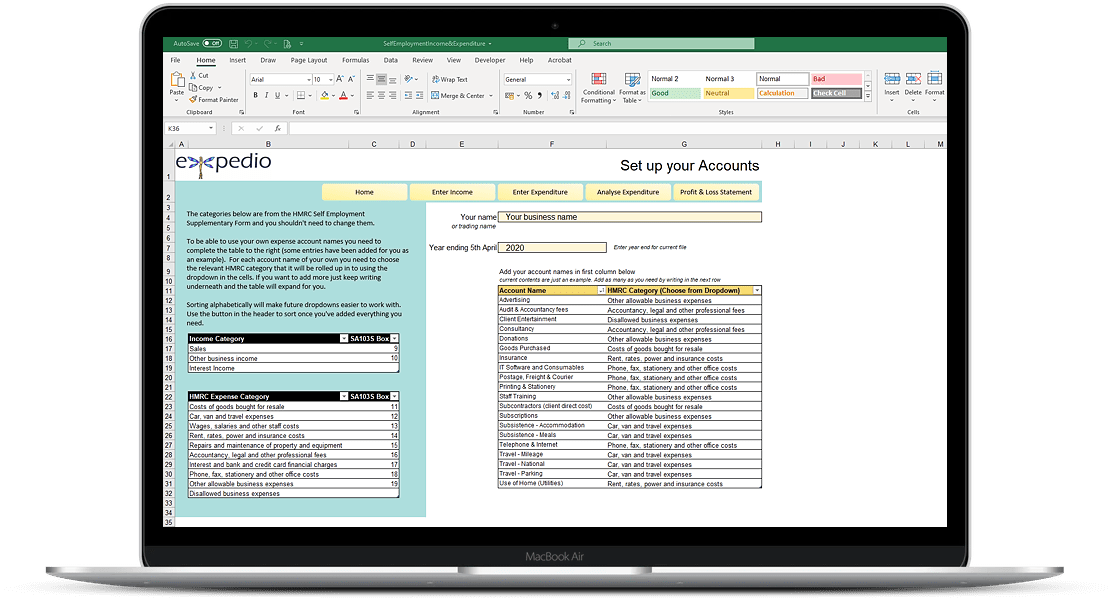

MATCH YOUR EXPENSES WITH HMRC CATEGORIES

This spreadsheet uses the identical categories that HMRC use on form SA103S, to make it simple for you to complete.

At the same time I know you might want to analyse your own expense categories in a little more details. So, in the setup you’ll create a list of all the categories, or expense accounts, you’d like to track in your own business and then, using a dropdown list, you’ll assign the overall HMRC category that you’d like to roll them up in to.

ADD YOUR INCOME

Your income is added on one screen and categorised using a dropdown.

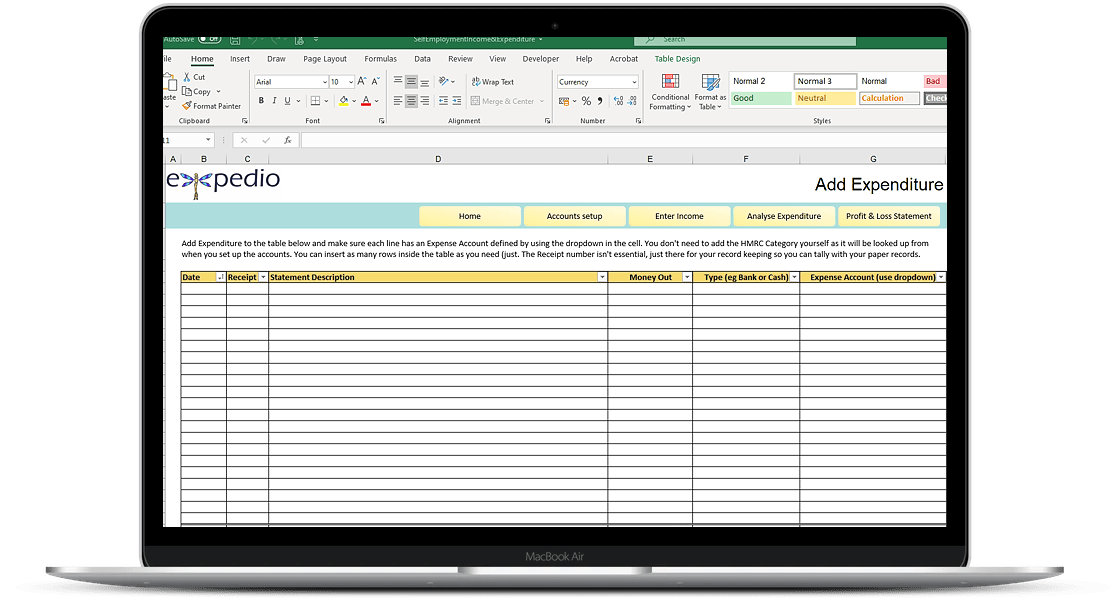

ADD YOUR EXPENDITURE

Your expenses are added on the next screen. I find it beneficial to download a transactions file from your bank and copy and paste those in here. You can then go through your receipts and either match them to a bank statement line, or add on a new line as a cash transaction.

You’ll then give each line its HMRC expense category. Sorting by description makes this process really fast as most of us have repeated transactions throughout the year.

MILEAGE TRACKER

Keep track of your mileage using our handy worksheet. The claim will be calculated and automatically added to your profit and loss. If you use the tracker you won’t need to add it separately to your expenses.

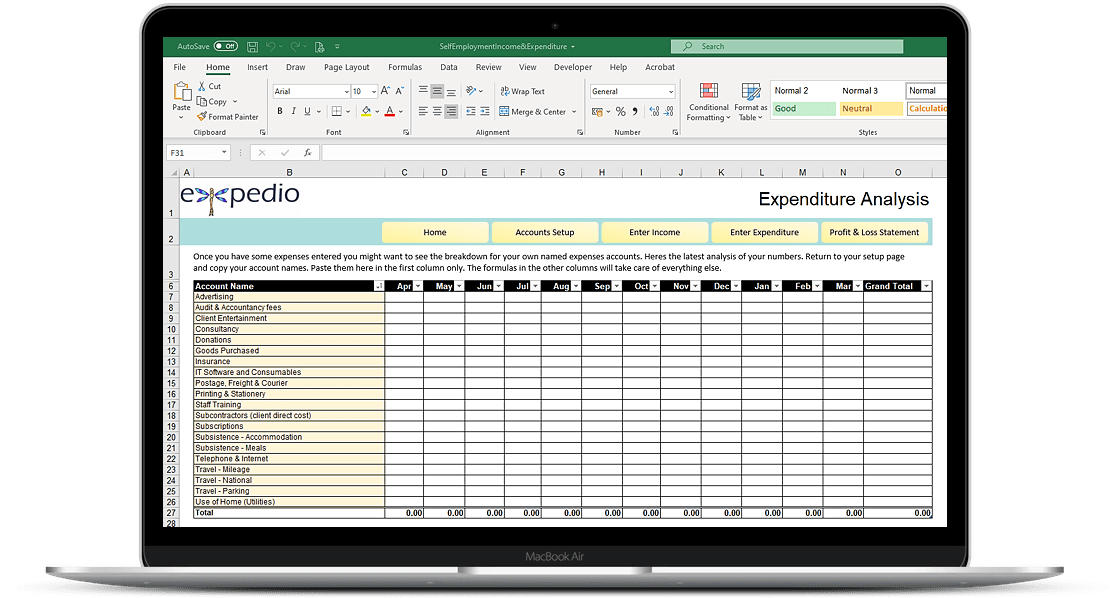

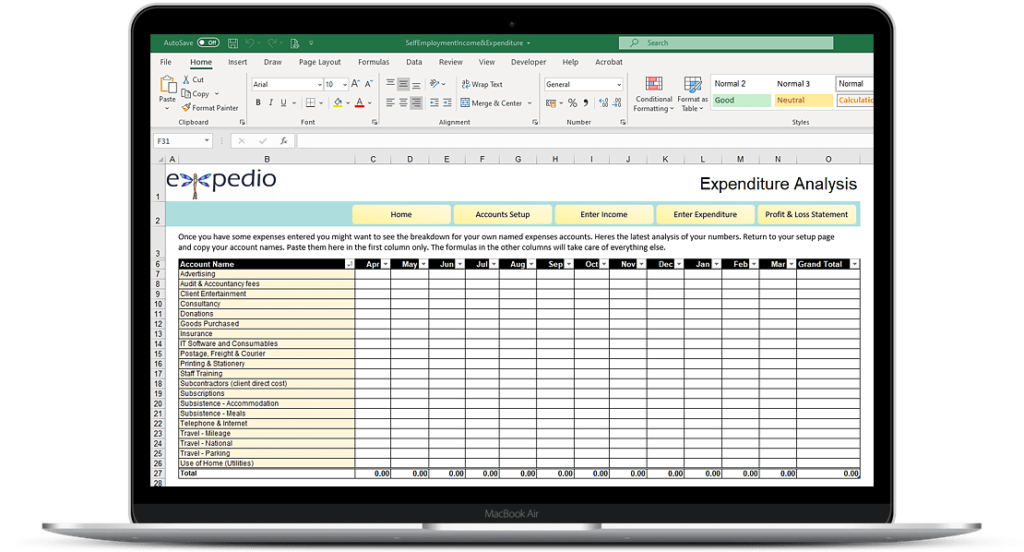

EXPENDITURE ANALYSIS

See the breakdown for your own named expenses accounts across the year. This is produced automatically with formulas pulling together the numbers from the data you’ve entered.

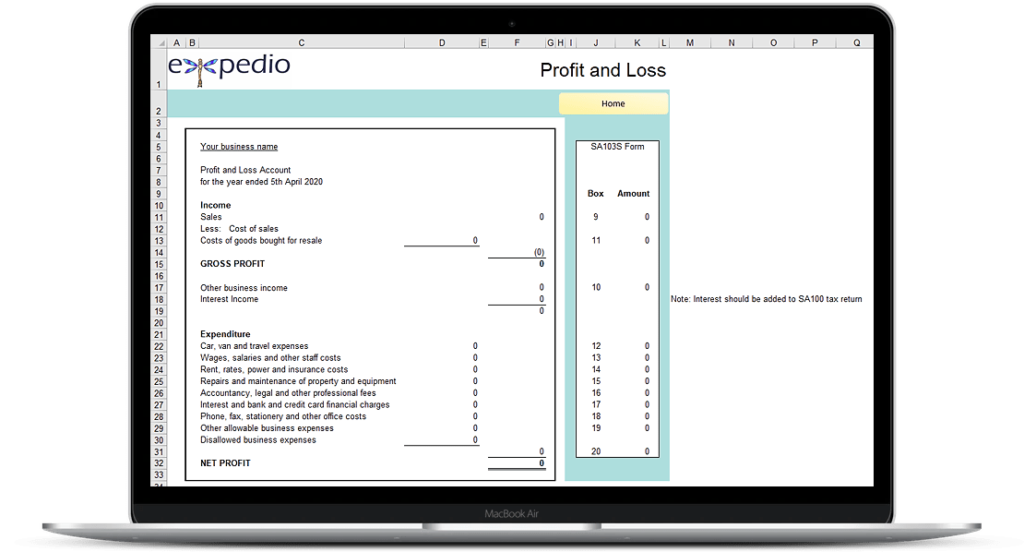

YOUR PROFIT & LOSS IS READY

Your Profit and Loss statement is now ready, all picked up from your categorisation when you entered your data.

And it’s also clear which number should be written in which box on the SA103S form.

TAX AND NATIONAL INSURANCE ESTIMATES

Wherever you are in the year, you’ll know exactly how much to set aside for your tax and national insurance payments as we’ve included the calculation for you. An estimate of your current tax liability is shown underneath the profit and loss. You’ll be able to change the tax thresholds so this will continue to work in future years as they change.

“Thanks so much for this handy spreadsheet tracker! I am absolutely clueless when it comes to excel and have zero understanding of it, so being able to access your income tracker has been a godsend. Such a handy little tool to have, especially for smaller-scale sole traders such as myself.”

JACK STREAMES

“Just spent most of today entering my 2020/21 figures and it has gone very well. What a very useful bit of kit for the self employed!”

ROGER NADIN

YOUR TAX RETURN HAS NEVER BEEN DONE SO QUICKLY, AND YOUR RECORDS HAVE BEEN ACCURATELY KEPT.

And next year you can do it as you go along!

For only £36, Buy now and get on top of your self employment accounts by tonight!

@JOANNE.SPARKES

on Instagram

Follow Along